How to Correct Errors in GSTR-1 and GSTR-3B, Get Practical GST Course in Delhi, 110009, by SLA Consultants India, New Delhi,

Mar 12th, 2025 at 10:32 Events Delhi 10 views Reference: X46dBB4Jd79Location: Delhi

Price: Contact us Negotiable

Errors in GSTR-1 and GSTR-3B can lead to tax mismatches, incorrect Input Tax Credit (ITC), and compliance issues. While GST returns cannot be revised, taxpayers can rectify mistakes in subsequent returns. Here’s how to correct common errors in GSTR-1 and GSTR-3B effectively.

1. Correcting Errors in GSTR-1

GSTR-1 reports outward supplies (sales). Errors in this return can affect the recipient’s ITC claims. GST Course in Delhi

Common Errors & Their Corrections:

Wrong GSTIN, Invoice Number, or Tax Rate:

- Amend in Table 9A (B2B), Table 9B (Credit Notes), or Table 9C (Exports) in the next GSTR-1.

Missed Invoices:

- Report missing invoices in the next GSTR-1 under the correct tax period.

Wrong Taxable Value or Place of Supply:

- Use the Amendment section in the next return to correct errors.

B2C Sales Reported as B2B:

- Amend under Table 10 (B2C Large Amendments) in the next GSTR-1.

2. Correcting Errors in GSTR-3B

GSTR-3B is a summary return used for tax payments and ITC claims. Since it cannot be edited post-submission, corrections must be made in future returns.

Common Errors & Their Corrections:

Excess ITC Claimed:

- Reverse the excess ITC in Table 4(B)(2) of the next GSTR-3B and pay with 18% interest.

Less ITC Claimed:

- Claim the unclaimed ITC in Table 4(A)(5) of the next GSTR-3B.

Understated or Overstated Sales:

- Adjust taxable value in Table 3.1 (Outward Supplies) of the next GSTR-3B.

Wrong Tax Paid (CGST instead of IGST or vice versa):

- Pay the correct tax in the next return and claim a refund for the excess paid.

3. Best Practices to Avoid Errors

Reconcile invoices with GSTR-1 and GSTR-3B before filing.

Use GSTR-2B for accurate ITC claims.

Set reminders for GST due dates to avoid last-minute mistakes.

Get Practical GST Training Institute in Delhi by SLA Consultants India

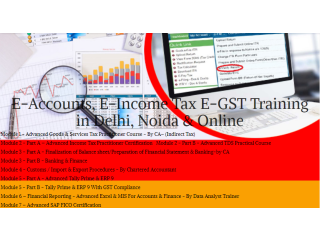

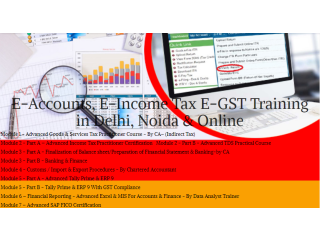

For hands-on GST training, SLA Consultants India offers a Practical GST Course in New Delhi (110009).

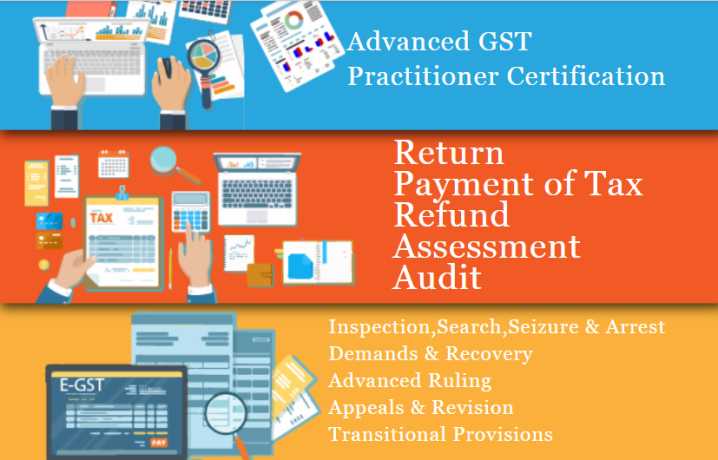

Course Highlights:

Live training on GST error correction & reconciliation.

Hands-on practice with Tally & Excel.

Learn GSTR-1, GSTR-3B, and ITC adjustments.

Ideal for accountants, tax professionals, and business owners.

SLA Consultant How to Correct Errors in GSTR-1 and GSTR-3B, Get Practical GST Course in Delhi, 110009, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar,New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website : https://www.slaconsultantsindia.com/

![Financial Modeling Training Course in Delhi, 110079. Best "Online Financial Analyst Training Course" in Patna by IIT Faculty , [ 100% Job in MNC]](https://xxads.com/storage/files/in/3395/thumb-320x240-5949440d81e2f879bf74aca0669aa93e.png)

![Data Analyst Course in Delhi, 110094. Certification for "Online Data Analyst Course with Placement" in Delhi NCR. [ 100% Job in MNC]](https://xxads.com/storage/files/in/3396/thumb-320x240-4e83906aa9659ec17ace2c017c84f4a0.png)